Understanding Stamp Duty and Property Registration Charges in Lucknow

- 05 January 2025

Explore the latest updates on stamp duty and property registration charges in Lucknow for 2025, including key rates, recent changes, and online payment processes.

In Lucknow, the stamp duty and property registration charges have become a significant concern for homebuyers in 2025. The Uttar Pradesh government has set varying rates based on gender and property type, impacting the overall cost of property transactions in the city.

Key Takeaways

- Stamp duty rates vary from 6% to 7% based on the buyer's gender.

- Registration charges are uniformly set at 1% of the property value.

- Recent government measures have reduced stamp duty for family property transfers.

Overview of Stamp Duty and Registration Charges

Stamp duty is a state levy that property buyers must pay during property registration. In Lucknow, the rates differ based on the buyer's gender and the nature of the property. For instance, male buyers typically pay 7% of the property value, while female buyers enjoy a 1% reduction, paying 6%. Joint ownership also offers a slight discount, with rates set at 6.5% for a husband and wife.

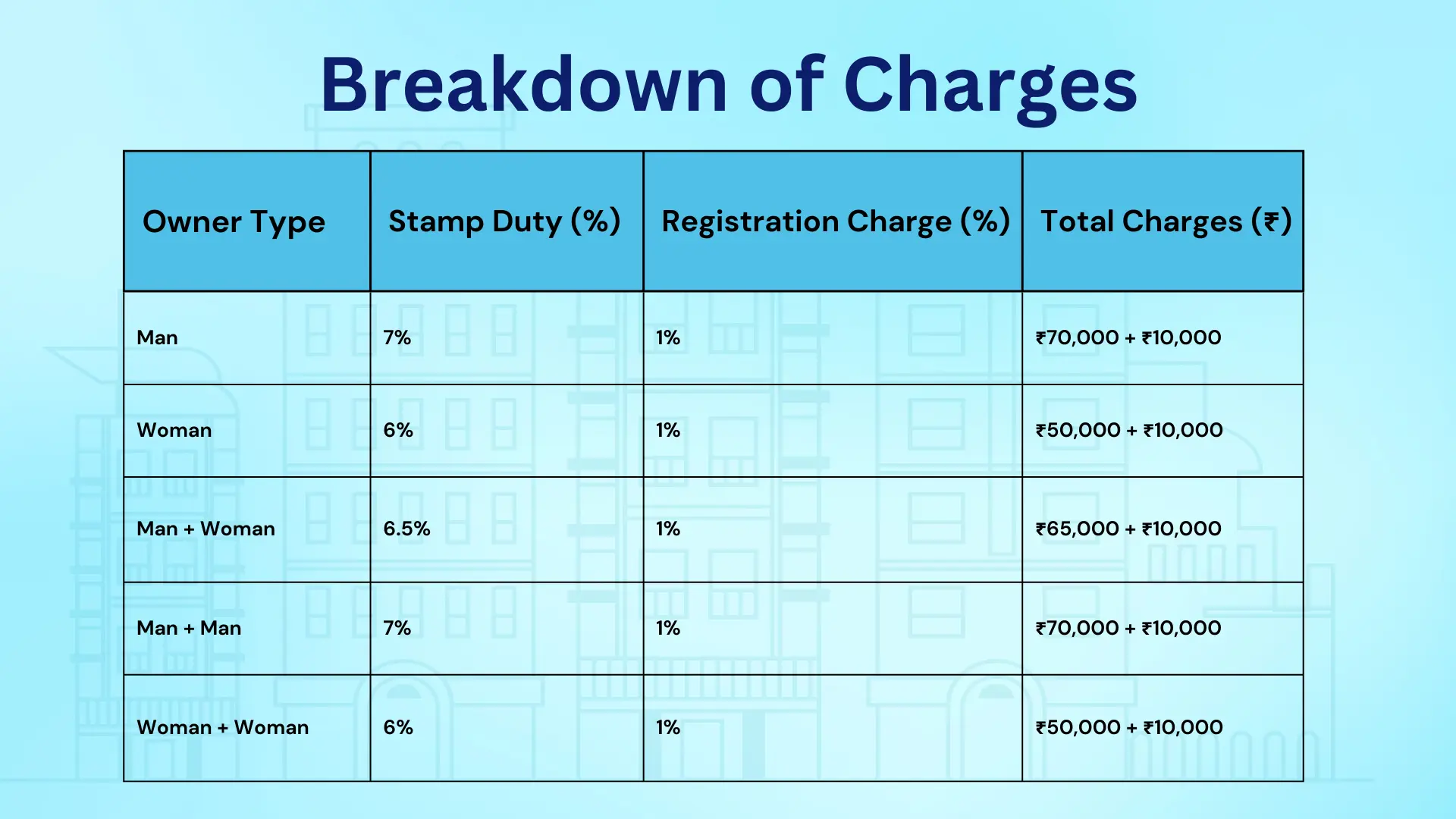

Breakdown of Charges

Here’s a quick breakdown of the stamp duty and registration charges for properties valued at ₹10 lakh:

|

Owner Type |

Stamp Duty (%) |

Registration Charge (%) |

Total Charges (₹) |

|

Man |

7% |

1% |

₹70,000 + ₹10,000 |

|

Woman |

6% |

1% |

₹50,000 + ₹10,000 |

|

Man + Woman |

6.5% |

1% |

₹65,000 + ₹10,000 |

|

Man + Man |

7% |

1% |

₹70,000 + ₹10,000 |

|

Woman + Woman |

6% |

1% |

₹50,000 + ₹10,000 |

Recent Changes in Stamp Duty

In August 2023, the Uttar Pradesh government introduced a significant relief measure by reducing stamp duty for property transfers among blood relatives to a nominal ₹5,000. This initiative aims to ease the financial burden on families during property transactions, reinstating a previous provision that had expired.

How to Calculate Charges

To calculate the stamp duty and registration charges, consider the following example:

- Property Value: ₹40 lakh (based on circle rate of ₹5,000 per sq ft for an 800 sq ft property)

- Stamp Duty: 7% of ₹40 lakh = ₹2.80 lakh

- Registration Charge: 1% of ₹40 lakh = ₹40,000

Thus, the total cost for the buyer would be ₹3.20 lakh.

Online Payment Process

Homebuyers can conveniently pay stamp duty and registration charges online through the official Uttar Pradesh portal. The steps include:

- Visit the official portal.

- Select ‘Apply Now’ and choose ‘New Application’.

- Complete the registration process.

- Log in and submit property details.

- The system calculates the charges.

- Complete the payment and save the receipt for future reference.

Conclusion

Understanding the stamp duty and registration charges in Lucknow is crucial for homebuyers. With the recent changes aimed at reducing financial burdens, it is essential to stay informed about the applicable rates and processes to ensure smooth property transactions in 2025.